Introduction

The process of business entity closure, known as company liquidation, encompasses activities such as selling assets, settling liabilities, and distributing remaining assets among shareholders. The specific type of liquidation and the corresponding procedures can differ, contingent upon the financial condition and decisions made by the company. Below are the typical types of company liquidation and their associated processes:

Types of Company Liquidation:

1. Voluntary Liquidation:

a. Members’ Voluntary Liquidation (MVL):

Initiation: Shareholders initiate the process when the company is solvent.

Appointment of Liquidator: Shareholders appoint a liquidator to realize assets, settle liabilities, and distribute remaining funds.

Distribution: Assets are distributed among shareholders after settling all debts.

b. Creditors’ Voluntary Liquidation (CVL):

- Initiation: Directors and shareholders decide to liquidate due to insolvency.

- Appointment of Liquidator: Creditors have a say in selecting the liquidator.

- Distribution: Liquidator prioritizes creditors’ claims, and any remaining funds are distributed among shareholders.

2. Compulsory Liquidation:

- Initiation: Usually initiated by creditors filing a winding-up petition due to unpaid debts.

- Appointment of Official Receiver or Liquidator: The court appoints an official receiver or a licensed insolvency practitioner as the liquidator.

- Distribution: Assets are sold, and proceeds are distributed according to statutory priorities.

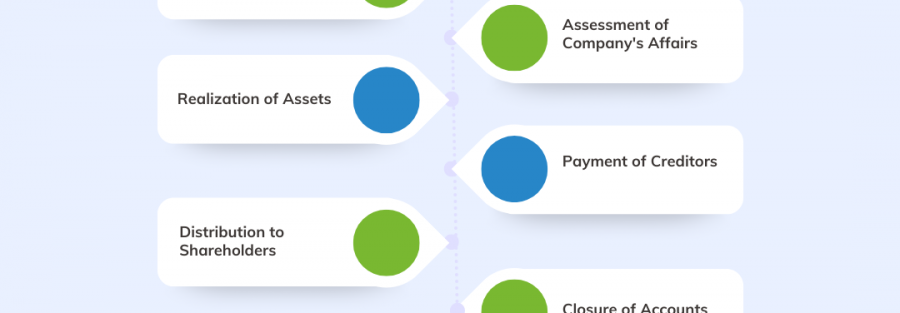

Liquidation Process:

1. Appointment of Liquidator:

- In voluntary liquidation, shareholders or creditors appoint a liquidator.

- In compulsory liquidation, the court appoints an official receiver or a liquidator.

2. Assessment of Company’s Affairs:

- The liquidator assesses the company’s financial position, identifies assets, and reviews liabilities.

3. Realization of Assets:

- Liquidator sells company assets, including property, inventory, and intellectual property, to generate funds.

4. Payment of Creditors:

- Creditors are paid according to their priority, as per legal requirements.

5. Distribution to Shareholders:

- Remaining funds, if any, are distributed among shareholders.

6. Closure of Accounts:

- Liquidator prepares final accounts, detailing the liquidation process and financial outcomes.

7. Dissolution and Striking Off:

- Formal application for dissolution is made to the relevant authorities.

- The company is struck off the register upon completion of the liquidation process.

8. Post-Liquidation Compliance:

- Ensure compliance with any post-liquidation requirements, such as filing final tax returns.

Conclusion:

The selection of the appropriate company liquidation method is contingent upon the prevailing financial circumstances of the business. Whether opting for a voluntary or compulsory liquidation, the overall process encompasses a systematic and organized winding down of the company’s operations. This includes addressing financial obligations, settling debts, and ultimately, leading to the dissolution of the company as a legal entity. Given the intricacies involved in the liquidation process, seeking professional advice becomes paramount. Consulting with experts who specialize in company liquidation is crucial for navigating the complexities, ensuring compliance with legal requirements, and making informed decisions that align with the best interests of the stakeholders involved. Professional guidance serves as a valuable resource to streamline the liquidation process, mitigate potential challenges, and safeguard the interests of creditors, shareholders, and other relevant parties.